Are you considering setting up a holding company in Singapore? Look no further! This ultimate guide will equip you with everything you need to know to successfully establish and operate a holding company in this bustling and business-friendly city-state. Singapore has long been recognized as a prime location for businesses looking to expand or establish […]

Are you considering setting up a holding company in Singapore? Look no further! This ultimate guide will equip you with everything you need to know to successfully establish and operate a holding company in this bustling and business-friendly city-state.

Singapore has long been recognized as a prime location for businesses looking to expand or establish a presence in Asia. With its robust legal framework, attractive tax incentives, and strategic geographical location, it’s no wonder that many multinational corporations choose Singapore as their preferred destination for setting up a holding company.

In this comprehensive guide, we will walk you through the entire process of setting up a holding company in Singapore, from understanding the legal requirements and registration procedures to navigating the tax system and compliance obligations. We will also delve into the benefits and potential challenges of running a holding company in Singapore, providing you with practical insights and expert advice.

Whether you’re an entrepreneur looking to optimize your corporate structure or a multinational corporation planning to consolidate your regional operations, this guide is your go-to resource for successfully establishing and managing a holding company in Singapore. Get ready to unlock new opportunities and take your business to the next level in this thriving economic powerhouse.

Advantages of Setting up a Holding Company in Singapore

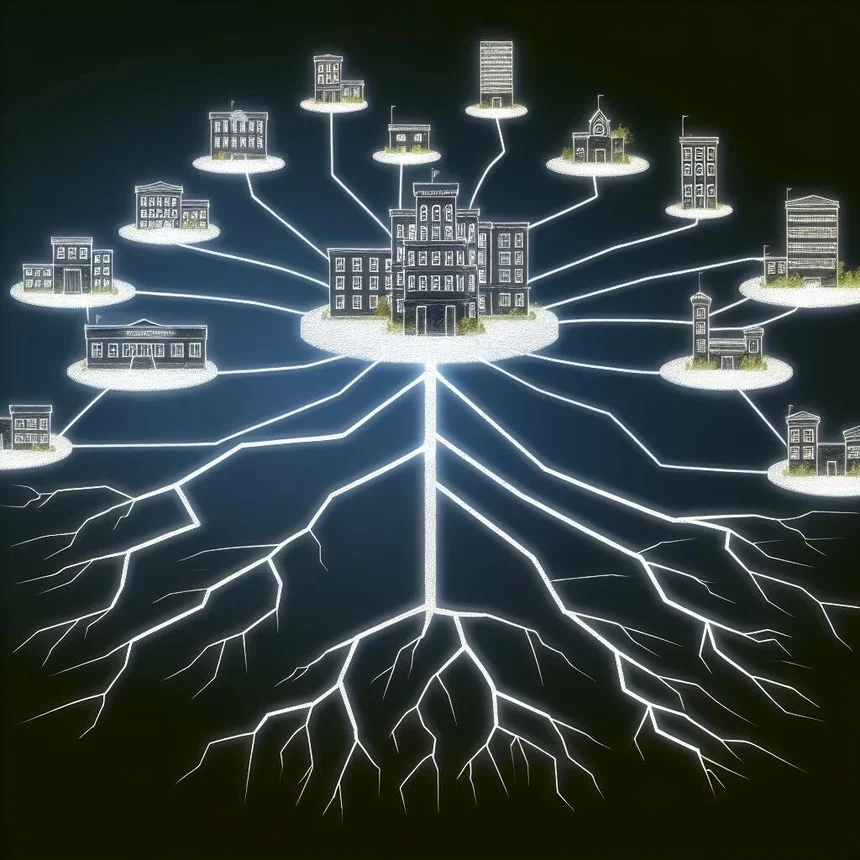

Setting up a holding company in Singapore offers a myriad of advantages for businesses looking to optimize their corporate structure. One key benefit is the ease of conducting business in Singapore, thanks to its pro-business environment and efficient regulatory framework. Holding companies in Singapore enjoy limited liability protection, which shields the assets of the parent company from the risks associated with its subsidiaries.

Another advantage of setting up a holding company in Singapore is the access to a wide network of Double Taxation Agreements (DTAs) that, which can help reduce tax liabilities and facilitate cross-border transactions. Singapore’s stable political climate and strong rule of law make it a secure and reliable jurisdiction for holding company operations. These factors, combined with the country’s strategic location in the heart of Asia, make Singapore an attractive hub for businesses seeking to expand their global footprint.

Establishing a holding company in Singapore also provides opportunities for cost savings and operational efficiencies. By consolidating ownership of subsidiary companies under a single entity, businesses can streamline management processes, reduce administrative overheads, and achieve economies of scale. Additionally, holding companies in Singapore benefit from a competitive tax regime that includes tax exemptions on foreign-sourced income and capital gains, making it an ideal location for holding and managing investments.

In summary, the advantages of setting up a holding company in Singapore are numerous and compelling. From limited liability protection to access to double taxation treaties and cost-saving opportunities, Singapore offers a conducive environment for businesses to thrive and grow. By leveraging the benefits of a holding company structure in Singapore, companies can enhance their operational efficiency, minimize risks, and maximize profits in today’s competitive global marketplace.

Legal Requirements and Regulations for Setting up a Holding Company in Singapore

Before establishing a holding company in Singapore, it is crucial to understand the legal requirements and regulations governing such entities. In Singapore, a holding company is typically incorporated as a private limited company under the Companies Act. The company must have a minimum of one shareholder, one director who must be a resident in Singapore, and a company secretary. Foreign individuals or entities can also own 100% of the shares in a Singapore holding company.

Apart from the basic requirements for company incorporation, holding companies in Singapore must comply with various regulations related to corporate governance, financial reporting, and compliance with tax laws. It is essential to ensure that the company’s constitution, known as the Memorandum and Articles of Association, is drafted in compliance with the Companies Act. Additionally, holding companies must maintain proper accounting records, conduct annual general meetings, and file annual returns with the Accounting and Corporate Regulatory Authority (ACRA).

In terms of regulatory oversight, holding companies in Singapore are subject to the supervision of government agencies such as ACRA and the Inland Revenue Authority of Singapore (IRAS). These agencies play a crucial role in ensuring that holding companies adhere to regulatory requirements, pay taxes promptly, and fulfill their compliance obligations. By staying abreast of the legal requirements and regulations applicable to holding companies in Singapore, businesses can avoid potential pitfalls and operate with confidence in this business-friendly jurisdiction.

Choosing the Right Business Structure for Your Holding Company

Selecting the appropriate business structure is a critical decision when setting up a holding company in Singapore. The choice of business structure will impact various aspects of the company’s operations, including its tax liabilities, regulatory requirements, and corporate governance framework. In Singapore, holding companies are commonly structured as private limited companies due to their flexibility, limited liability protection, and tax efficiency.

Private limited companies offer several advantages for holding companies, such as separate legal personality, limited liability for shareholders, and ease of transferability of shares. By operating as a private limited company, a holding company can enjoy the benefits of perpetual succession, meaning that the company can continue its operations even in the event of changes in ownership or management. This provides stability and continuity for the holding company’s business activities.

Another important consideration when choosing the business structure for a holding company is the number and nature of its subsidiaries. Holding companies can have either a single-tier structure, where they directly own subsidiary companies, or a multi-tier structure, where they own subsidiary companies through intermediate holding companies. The choice between a single-tier and multi-tier structure will depend on factors such as the complexity of the group structure, tax planning considerations, and regulatory requirements.

In conclusion, selecting the right business structure is a crucial step in establishing a holding company in Singapore. By carefully considering the advantages and implications of different business structures, companies can create a solid foundation for their holding company operations and position themselves for long-term success in the dynamic business landscape of Singapore.

Tax Benefits and Incentives for Holding Companies in Singapore

Singapore offers a range of tax benefits and incentives to attract holding companies and encourage investment in the country. One of the key benefits for holding companies in Singapore is the territorial tax system, which exempts foreign-sourced income from taxation in Singapore, provided certain conditions are met. This means that holding companies in Singapore are not subject to tax on dividends, capital gains, and other income earned outside the country.

In addition to the territorial tax system, holding companies in Singapore can benefit from various tax incentives aimed at promoting business growth and innovation. For example, qualifying holding companies may be eligible for tax incentives such as the Global Trader Program (GTP), which provides concessionary tax rates on qualifying trading income. Holding companies engaged in qualifying activities, such as investment holding or regional headquarters services, may also enjoy tax exemptions or incentives under specific schemes.

Another tax benefit for holding companies in Singapore is the absence of capital gains tax and estate duty, making it an attractive jurisdiction for holding and managing investments. Singapore’s competitive corporate tax rate of 17% and extensive network of double taxation treaties further enhance the tax efficiency of holding company operations in the country. By leveraging these tax benefits and incentives, holding companies can optimize their tax structure, reduce their tax liabilities, and enhance their overall profitability.

In summary, the tax benefits and incentives available to holding companies in Singapore make it a compelling destination for businesses seeking to establish a tax-efficient corporate structure. By taking advantage of the territorial tax system, tax incentives, and competitive tax rates, holding companies can minimize their tax exposure and maximize their after-tax returns, ultimately creating a conducive environment for sustainable growth and success in Singapore’s vibrant business landscape.

Registering Your Holding Company in Singapore

The process of registering a holding company in Singapore involves several steps to ensure compliance with legal requirements and establish the company’s legal presence in the country. The first step is to reserve a company name with the Accounting and Corporate Regulatory Authority (ACRA). The proposed name must be unique, not identical to existing company names, and comply with ACRA’s guidelines on company names.

Once the company name is approved, the next step is to prepare the necessary incorporation documents, including the Memorandum and Articles of Association, consent to act as director and shareholder forms, and the company’s registered office address. These documents must be submitted to ACRA for registration along with the payment of the registration fees. Upon successful registration, ACRA will issue a Certificate of Incorporation, confirming the establishment of the holding company.

After incorporating the holding company, the next crucial step is to apply for relevant licenses and permits, if required for the company’s operations. Depending on the nature of the business activities, holding companies may need to obtain licenses from regulatory authorities such as the Monetary Authority of Singapore (MAS) or the Infocomm Media Development Authority (IMDA). It is essential to ensure compliance with all regulatory requirements to avoid any penalties or legal issues.

In addition to registering the holding company with ACRA, companies must also register for goods and services tax (GST) if their taxable turnover exceeds the GST registration threshold. GST registration enables holding companies to claim input tax credits on their business expenses and comply with their GST filing obligations. By completing the registration process and obtaining the necessary licenses and permits, holding companies can establish a solid legal foundation for their operations in Singapore and operate with confidence in the local business environment.

Opening a Corporate Bank Account for Your Holding Company

Once the holding company is registered in Singapore, the next step is to open a corporate bank account to facilitate its financial transactions and operations. Choosing the right bank for the holding company’s corporate account is crucial, as it can impact the company’s ability to conduct business efficiently and access banking services. Singapore offers a diverse range of local and international banks that cater to the needs of corporate clients, providing various banking products and services to meet different business requirements.

When opening a corporate bank account for a holding company in Singapore, banks typically require certain documents to verify the company’s identity and the identity of its directors and shareholders. These documents may include the Certificate of Incorporation, Memorandum and Articles of Association, business profile from ACRA, directors’ and shareholders’ identification documents, and proof of the company’s registered address. It is essential to prepare these documents in advance to expedite the account opening process.

In addition to the required documents, banks may also conduct due diligence checks on the holding company and its beneficial owners to ensure compliance with anti-money laundering (AML) regulations and know-your-customer (KYC) requirements. The bank may request additional information or clarification on the company’s source of funds, nature of business activities, and expected transaction volumes. By providing accurate and timely information to the bank, holding companies can establish a transparent banking relationship and access the full range of banking services available in Singapore.

Overall, opening a corporate bank account is a critical step in setting up a holding company in Singapore, enabling the company to manage its finances, receive payments, and conduct business transactions effectively. By choosing a reputable bank, preparing the necessary documents, and complying with regulatory requirements, holding companies can establish a strong financial foundation and access the financial services needed to support their growth and expansion plans in Singapore and beyond.

Compliance and Ongoing Obligations for Holding Companies in Singapore

Compliance with regulatory requirements and ongoing obligations is essential for holding companies in Singapore to maintain their legal status and operate smoothly in the business environment. Holding companies must adhere to various compliance obligations related to corporate governance, financial reporting, tax filing, and regulatory filings to ensure transparency, accountability, and legal compliance. Failure to comply with these obligations can result in penalties, fines, or even the revocation of the company’s registration.

- Filing of Annual Returns and financial statements with ACRA. Annual returns must be filed within 7 months after the company’s financial year-end, along with the company’s financial statements prepared in accordance with the Singapore Financial Reporting Standards (SFRS). Holding companies must also hold annual general meetings (AGMs) to present and approve the financial statements and appoint directors.

- Comply with Corporate Income Tax regulations and fulfill their tax obligations promptly. This includes filing corporate income tax returns with the Inland Revenue Authority of Singapore (IRAS) and paying taxes on time to avoid penalties and interest charges. Holding companies must also maintain accurate accounting records, prepare financial statements, and comply with transfer pricing regulations to ensure compliance with tax laws.

Apart from corporate governance and tax compliance, holding companies in Singapore must also be aware of regulatory changes and updates that may impact their operations. It is essential to stay informed about changes in laws, regulations, and industry developments to adapt the company’s business strategies and compliance practices accordingly. By proactively monitoring regulatory changes and seeking professional advice when needed, holding companies can navigate the complex regulatory landscape in Singapore and operate with confidence in a compliant and sustainable manner.

In conclusion, compliance with regulatory requirements and ongoing obligations is a fundamental aspect of operating a holding company in Singapore. By maintaining transparency, accountability, and legal compliance, holding companies can build trust with stakeholders, mitigate risks, and position themselves for long-term success in the competitive business environment of Singapore. Adopting a proactive approach to compliance management and seeking professional guidance can help holding companies navigate regulatory challenges and achieve sustainable growth and profitability in the dynamic business landscape of Singapore.

Case Studies and Success Stories of Holding Companies in Singapore

To illustrate the practical application of setting up and operating a holding company in Singapore, let’s explore some case studies and success stories of companies that have successfully leveraged the benefits of a holding company structure in the country. These real-life examples demonstrate how holding companies in Singapore have achieved operational efficiency, tax optimization, and business growth by establishing a presence in this business-friendly jurisdiction.

Case Study 1: Company A is a multinational corporation with diverse business interests across Asia. By setting up a holding company in Singapore, Company A was able to centralize its ownership structure, streamline management processes, and access Singapore’s extensive network of double taxation treaties. As a result, Company A reduced its tax liabilities, enhanced its operational efficiency, and expanded its regional footprint, positioning itself for sustainable growth and profitability in the competitive Asian market.

Case Study 2: Company B is a tech startup with innovative products and services seeking to attract investment and scale its operations globally. By establishing a holding company in Singapore, Company B gained access to Singapore’s vibrant startup ecosystem, investor-friendly environment, and robust legal framework. The holding company structure enabled Company B to attract foreign investors, protect its intellectual property rights, and access funding opportunities, paving the way for accelerated growth and market expansion.

These case studies highlight the diverse benefits and opportunities that holding companies in Singapore can offer businesses of all sizes and industries. Whether you’re a multinational corporation looking to optimize your corporate structure or a startup seeking to expand your global footprint, setting up a holding company in Singapore can provide a strategic advantage and unlock new opportunities for growth and success. By learning from these case studies and success stories, businesses can gain valuable insights and inspiration to embark on their own journey of establishing and operating a holding company in the dynamic business landscape of Singapore.

Conclusion and Key Takeaways

In conclusion, setting up a holding company in Singapore offers a host of advantages and opportunities for businesses looking to enhance their corporate structure, optimize their tax efficiency, and expand their global presence. From the attractive tax benefits and incentives to the robust legal framework and pro-business environment, Singapore provides an ideal setting for holding companies to thrive and grow in today’s competitive business landscape.

By understanding the legal requirements, choosing the right business structure, leveraging tax benefits, and ensuring compliance with regulatory obligations, businesses can establish a solid foundation for their holding company operations in Singapore. Through proactive management of compliance, strategic tax planning, and operational efficiency, holding companies can navigate the complexities of the business environment in Singapore and position themselves for sustainable growth and success.

As you embark on the journey of setting up a holding company in Singapore, remember to seek professional advice, stay informed about regulatory developments, and continuously evaluate your business strategies to adapt to changing market conditions. By harnessing the benefits of a holding company structure in Singapore and embracing the opportunities it offers, you can unlock new horizons for your business and take it to the next level in this dynamic and thriving economic powerhouse.

In summary, the ultimate guide to setting up a holding company in Singapore has provided you with comprehensive insights, practical advice, and real-life examples to equip you with the knowledge and confidence to establish and operate a successful holding company in this vibrant business hub. By following the guidelines outlined in this guide and leveraging the opportunities available in Singapore, you can embark on a rewarding journey of growth, innovation, and success in the ever-evolving world of business.